It’s no secret that the stock market is a risky investment. And when the market is uncertain, as it is now, it can be tough to know what to do with your money. Should you invest in stocks?

Bonds? Gold? Or maybe just keep your cash in the bank?

There are many options out there, and it can be tough to make a decision. But don’t worry – we’re here to help. This article will discuss some of the best ways to invest your money when the stock market is uncertain.

We’ll also talk about the risks and rewards associated with each investment option, so you can make an informed decision.

Consider short-term investments.

Short-term investments, such as cash or Treasury bills, can be safe to invest your money when the stock market is uncertain. These investments are less risky than longer-term investments, and they can provide a higher return than keeping your money in a savings account.

Invest in stocks.

When the stock market is uncertain, it can be a good time to invest in stocks. While there is always some risk associated with investing in stocks, they can provide a higher return than other investment options.

Invest in bonds.

Bonds are a less risky investment than stocks, and they can provide a stable return over time. When the stock market is uncertain, it can be a good time to invest in bonds.

Invest in gold.

Gold is often seen as a safe investment during times of uncertainty. It’s not as risky as stocks or bonds, and it tends to hold its value even when the stock market is volatile.

Keep your money in the bank.

If you’re not sure what to do with your money, it can be a good idea to keep it in the bank. This is a safe investment option, and it’s also guaranteed to provide a return.

Invest in mutual funds or ETFs.

Mutual funds and ETFs can be more diversified and less risky than investing in individual stocks. Mutual funds and ETFs can also be more liquid than individual stocks, making them easier to sell.

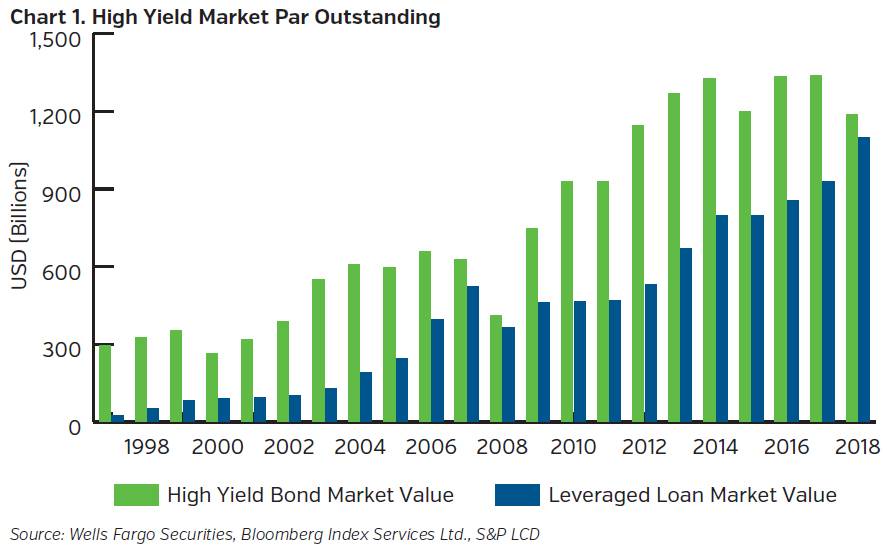

Be careful with high-yield bonds.

High-yield bonds can be a good investment option when the stock market is uncertain, but they can also be quite risky. It’s important to do your research before investing in high-yield bonds and to make sure you know what you’re getting into.

Avoid penny stocks.

Penny stocks are a very risky investment, and they should be avoided when the stock market is uncertain. These stocks are often not listed on major exchanges, which can be difficult to sell.

They also tend to have high volatility, meaning they can quickly go up or down in value.

Stay away from high-risk investments.

When the stock market is uncertain, it’s best to avoid investing in high-risk assets. These investments can be more volatile and may lose value quickly during turmoil. Instead, invest in safer options, such as bonds or cash.

Consult a financial advisor.

If you’re not sure what to do with your money, it can be helpful to consult a financial advisor. Financial advisors can help you find the best investment options for your specific situation, and they can also help you manage your portfolio during times of volatility.

Invest in commodities.

Commodities such as gold, silver, and oil can be a safe investment during uncertainty. These commodities can be a hedge against inflation, and they may be less risky than other investments. They may also provide a higher return than other investments, such as cash or bonds.

Consider a CD.

When the stock market is uncertain, it can be a good time to invest in a CD. CDs are a low-risk investment option, and they offer a fixed return over time. This can be a worthwhile investment if you’re looking for stability during turbulent times.

Consider real estate.

Real estate can be a safe investment, especially if you’re looking for a moderate return. Real estate can also provide a hedge against inflation. However, real estate is a relatively illiquid investment, which can be challenging to sell.

Invest in foreign stocks.

When the stock market is uncertain, it can be good to invest in foreign stocks. Foreign stocks are less likely to be affected by turmoil in the U.S. stock market. Additionally, foreign stocks may provide a higher return than domestic stocks and can help you diversify your portfolio and reduce your risk.

Invest in alternative investments.

Several alternative investment options, such as real estate and hedge funds, can offer a higher return than traditional investments. However, these investments are also riskier. It’s essential to do your research before investing in any alternative investment.

Stay invested.

When the stock market is uncertain, it can be tempting to sell all of your stocks and move your money into cash. However, this may not be the best course of action. If you sell your stocks when the market is down, you may miss out on the potential for future growth. It’s usually best to stay invested to maximize your return.

Diversify your portfolio.

Investing in various assets can help you reduce the risk of losing money if the stock market takes a downturn. By investing in stocks, bonds, and other types of assets, you can spread your risk across many different investments. This can help you protect your portfolio if one investment loses value.

Stay informed.

It’s essential to stay informed about the stock market and the economy if you’re investing your money. By staying up-to-date on the latest news, you’ll be able to make more informed investment decisions. You can find a variety of financial news sources online, or you can consult with a financial advisor.

Don’t panic.

When the stock market is uncertain, it’s easy to get scared and want to pull your money out of the market. But remember that markets always go up and down, and there’s no guarantee that

you’ll make more money by pulling your money out now. Instead, try to stay calm and make an informed decision about what to do with your money.

Summary

In short, there are a lot of different ways to invest your money when the stock market is uncertain. It’s essential to do your research and understand the risks and rewards associated with each investment option before deciding. By following these tips, you can make sure your money is in safe hands.